Smiling It Forward With Tylenol

I have received information and products from McNeil Consumer Healthcare Division of McNEIL-PPC, Inc., the makers of TYLENOL®. The opinions stated are my own. This is a sponsored post for SheSpeaks. What does it...

This is a sponsored post written by me on behalf of Visa.

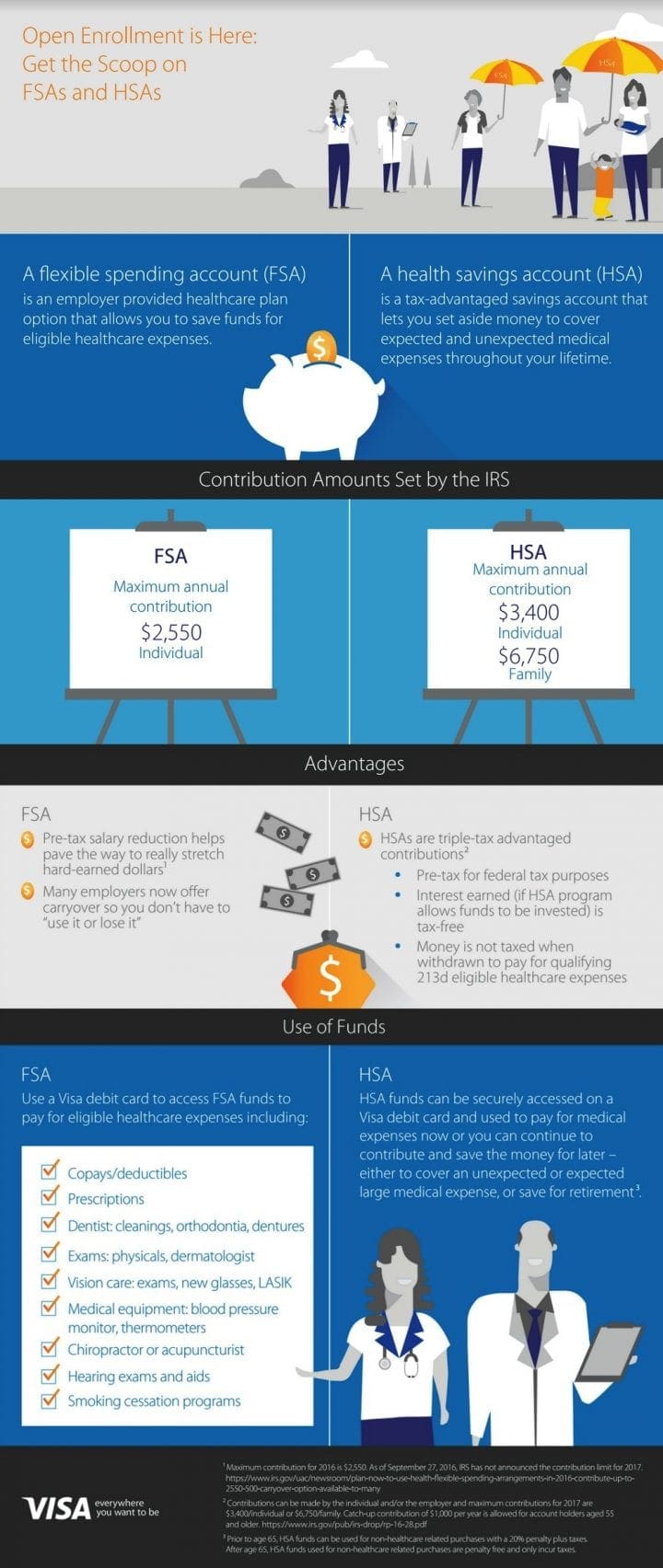

We have a family of five and being self-employed (my husband and I both work together) means that we have health insurance with a pretty high deductible. Our out-of-pocket expenses for doctor visits, prescriptions and other healthcare related items add up quickly. This is where our Health Savings Account (HSA) has been very helpful. Do you have an HSA?

We didn’t have one at first because I just didn’t understand the need for it. However, after learning more about what an HSA is and how it works, I immediately set one up for my family because honestly, it is really something that we can use and it is a great way to save for expenses that people don’t always budget for.

An HSA (offered with a qualifying high-deductible health plan) is a tax-advantaged savings account that allows you to set aside money to cover medical expenses throughout your lifetime. It is like an IRA savings account for your health. The money you put in the HSA is tax-deductible. Also, the money you withdraw isn’t taxed, as long as you spend it on eligible healthcare expenses. Plus, any interest earned on your HSA is also tax-free. And, after you turn 65, you can take out money from your HSA for non-healthcare related expenses penalty-free.

You can use money from your HSA to pay for eligible healthcare expenses including:

However, you cannot use funds from your HSA to pay for your health insurance premium — unless you’re unemployed.

In 2017, the maximum annual contribution to an HSA is $3,400 for individual (self-only) and $6,750 for family coverage. If you’re in the 25 percent tax bracket, that could give you annual savings of up to $850 for individual and $1,687 for family coverage.

Simply put, an HSA is like a personal savings account where the money can be used to pay for eligible healthcare expenses. You — not your employer or insurance company — own and control the money in your HSA. Any money in your HSA that you don’t use stays in the account and will rollover year after year and can earn interest every year tax-free.

An HSA offers you a triple-tax advantage – (1) Contributions to an HSA are tax-deductible, (2) Money withdrawn from an HSA to pay for eligible medical expenses is tax-free, and (3) You can earn interest on funds invested in an HSA tax-free!

With an HSA, you can pay for medical expenses now or you can continue to contribute and save the money for later either to cover an unexpected or expected large medical expense, or save for retirement. And, if your employer doesn’t offer an HSA, you can get it on your own!

Did you know that you can access your HSA funds with a Visa Healthcare card? That’s right. One of the most convenient and secure ways to access funds in your HSA is with a Visa Healthcare card which allows you to pay for qualified healthcare expenses wherever Visa debit cards are accepted, making it easy to pay for expenses. So, remember to ask for a Visa Healthcare card when you get an HSA! To learn more, visit www.visahealthcare.com.

We have an HSA account and I love it. It helps me not to worry as much about the medical bills when they come in. Also for the dentist because the dentist can be very expensive.

In my family we all have sensitive digestive tracts. Before using probiotics someone would have tummy issues at any given time. However, since we started taking probiotics on a daily basis we have not had a single issue.

IDK if the widget has the right question, because it is asking about probiotics and this post is not about probiotics. However, probiotics help me reduce stomach problems and maintain a healthy digestive tract.

Regarding the post topic of HSAs, I didn’t realize you could get one on a debit card. I’ll have to look into that!

Yes! Thank you for all of this great information! My husband and I got an HSA this year and it’s been wonderful!

We definitely need to look into getting an HSA. This sounds like a better way to go about our healthcare options.

This is a really good idea. You never know when something is going to happen and you might need some extra money to cover health bills.

I will have to look into making an account like this. It would be nice knowing we had some cash put away for health emergencies.

We have a Health Savings Account. It is so important to save up for emergencies.

A friend of mine has an HSA account and she loves it. I’m definitely checking it out!

A HSA sounds like a really good idea. Even though we don’t have those here it’s always a good idea to put money aside for unexpected medical expenses.

I have never heard of an HSA before. This is great info for me. I will need to look into this!

Health Savings Accounts are an important part of health care. Ours came in handy a few years ago and I would prefer never to be without one again.

I have just recently started using probiotics for myself and have found myself feeling so much better. I don’t feel as bogged down.

I’ve heard about health savings accounts and all the points you make underscore how important it is for everyone to have one. After all, getting sick as you age is an increasingly possibility.

This is really informative and very helpful. Health savings is really important. Planning to discuss this with my husband.

Many great benefits to HSA accounts, I definitely have to look into it.

I am actually just learning about HSA’s. My husband is switching jobs and they offer this, and it is such a great idea!

Thank you so much for this info! I am also self employed and never knew how much I could benefit from an HSA account! Definitely going to do my research thanks to your blog post!

Pingback: Clues that your partner may be cheating on you financially

Pingback: What is financial infidelity

Pingback: Keep These 5 Things in Mind Before You Buy a New House

Pingback: How To Start A Wellness Business