How To Take Control Of My Finances

How To Take Control Of My Finances

We are well into the fourth month of the year but do you feel like your finances are under control? I am not sure that I ever feel completely under control but we do manage to get a better handle on things when we actively take the steps below. We hope that you are inspired by this How to Take Control of My Finances post.

How to Take Control of My Finances

Get a total picture of your financial health.

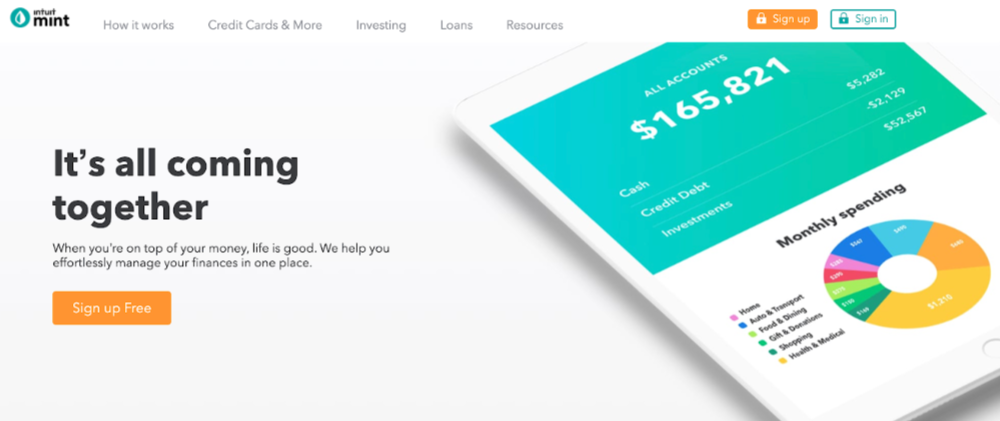

Track everything that you spend through budgeting apps. Save money on the things that you already buy. Try an app like Mint which lets you set goals and track your spending, get your credit score, and track your progress over time.

This free app can help to get you started on the path towards a better financial future.

Write it all down.

Write down your goals and keep them front and center in your home so everyone can see them. By making it visual and something that you have to see every day, you are much more likely to keep your goals at the top of your mind.

Live on less.

This may be tougher for some but try something like spending $25 less a week. You can find $25 somewhere in your budget to save money. Mint can help you track everything you spend in one easy place and then you can adjust your budget from there.

We have been using Mint for years. Consider calling your cable company, Internet & phone services, and utilities to make certain that you have the best rates possible.

Pay off debt.

You can double up on payments, if possible, or refinance to combine payments. Whatever you do, put as much as you can towards debt especially those with high interest rates.

Build up savings and add to retirement accounts.

Some apps will help you build great savings or invest in retirement accounts by using your everyday spending to simply “round up.” Our bank has offered this service for years and has allowed us to build a small savings account.

Even if you can't add much, consider adding any amount to your accounts on a weekly or monthly basis. Add to your 401K especially if you have a company match plan. Open one up if you haven't already.

Celebrate your successes.

Pay something off that was holding you back or is that high-interest credit card now at a $0 balance? Acknowledge it so you can celebrate these successes to hopefully help do it over and over again.

File your taxes and take advantage of any refunds.

If you’re expecting a refund, the sooner you file, the sooner you’ll get your money! Last tax season close to 72% of taxpayers received a tax refund close to $3,000!

The IRS typically issues nine out of 10 tax refunds within 21 days or less from acceptance with e-file and direct deposit. You could get a jump-start on paying down debt or save for a rainy day.

If you owe money, there’s still a good reason to file before the deadline! If you submit your tax return in April, you don’t have to pay taxes you owe until the extended federal deadline in mid-July.

Preparing your taxes early will give you time to figure out how you’re going to pay, or other options if you owe. You may even be able to contribute to your IRA before the tax deadline and reap the benefits of an additional tax deduction on your 2019 taxes.

Thank you for these wonderful tips on taking control of your finances! This is so important and something that my husband and I have been working on and it is so true that money equals freedom. It makes life easier and there really is nothing that you cannot do when you have money so saving and getting to that place is for sure something that we are working to achieve. Thanks for the tips and will use a few as well 🙂 Good luck to you on your saving journey!

These are all great tips. My husband is the one who always keeps our credit in check. My part is taking care that we don’t go over our budget for groceries and other essentials. I always have a list when I shop and I always pay in cash. Our tax refund (if any), automatically goes into a retirement savings account.

Some really great tips for helping to get on track with your finances! In such crazy times, looking after your finances has never been more important! Sim x

This couldn’t have come at a better time. With the current lockdown situation, finances are tight. I appreciate the suggestions.

These are pretty awesome and relatable tips, especially the reminder to do the taxes and to celebrate your successes, as it keeps you in a good frame of mind with regards to money and debt!

I have really been working on my finances this year. Thank you for these additional tips.

Getting control of finances is such an important thing to do and it always amazes me how many people let it go without worry. Getting things under control is a great idea. Thanks for the reminder to make sure I am on track.

This has to be THE year to take control of finances. I think the current crisis presents the perfect opportunity to do so, especially when it comes to living on less.

I think a lot of people look at this lockdown as a set back but I think it can be a great time to reevaluate our lives and plan ahead our goals. Great tips to practice and regain control. Thanks for sharing!

I mean, since we have MORE TIME (so to speak)… Taking care of managing finances should definitely be put on the front burner!!! Great tips!

Financial control is little bit difficult job for me, because my wife looks after the finances of our house, I just pay salary to her and she manage it…. Love to read your recommendation for 2020 year as a financial controlled year ….

Such a well-written article with great tips. I need to file my taxes now…

This is the year to take care of finances. Feel like we are forced to do it at this point. I love the idea of writing it all down…because when I see what I have spent on paper, it is so eye opening.

oh I need to do a lot in this area and quite frankly I don’t know from where to start. Thank you so much for the info, I can’t wait to get on it SOON…

Great tips to share on this. I too want to make this my year to take control of my finances. I don’t really have a lot of debt so I use that as an excuse BUT the debt is there. Time to tackle it!

I will be with you on this! Will do the same for this year. Thanks for all the tips!

Very useful tips. Taking control of your finances is a priority. Having emergency savings for a rainy day is so important, we came to realize it the hard way,

I love these ideas. I’m always careful with my money. You never know what can happen down the line, so it’s best to be careful, always!

2019 was my year to take control. 2020 and this pandemic has totally messed up all of my hard work.

These are cool tips to take control of one’s finances. I specially like the one about living on less. I actually teach my teenage kids to live on less by saving on things like food and money.

Thank you so much for sharing your tips :). Finances are absolutely so important. Taking control of them as much as you are able to is a pretty powerful form of self-care.

I am with you on this! I’ve just started fixing my finances last year. These will come handy.

Thanks for these tips. I’m all about the idea of passive saving. Acorns is the “round-up” app that I used before and it’s great. A majority of us are getting practice living on less these days. You might want to write a blog post encouraging us not to go wild and splurge once the quarantine is over though lol.

I must say that I am proud of myself, I am learning to set financial goals and I am glad that so far I have managed to achieve them, in short, it is the demonstration that with the right organization you can do everything!

Although this is a difficult time to manage finances because a lot of people lost their job, I hope that everyone can recover and learn from the old ways that didn’t work out.

Taking control of your financial should be like an essential. I’m learning my way through financial intelligence and these are some good points.

Currently, I think that many people will me looking at their finances for sure. good tips here x

This is such a great idea for this year and something positive to focus on. Thanks so much for sharing this with all of us!

What a timely post. Definitely a great idea to sit down and look at the big picture. This pandemic has been such a wake up call to so many people

I’ve generally been good with my finances, but with the current world condition, buckling down even more is essential. Something I would add is if you are getting that much money back it taxes, it might be worth adjusting your withholdings. Yes, your tax return will be much smaller, but it’s already your money to begin with, and who doesn’t want their money on hand when they need it.

These are great suggestions. With all the ups and downs this year has had so far, it is so important to stay on top of finances and keep them in check. Thanks for the info!

Such a good topic! I’m with you about this!!

I think the pandemic really hit a lot of people and it teaches us the basic lesson of saving up. It made us realize that we need extra or emergency money in times of needs.

as good as your suggestions are – i fear that this Covid-19 pandemic might make it extra hard for people to accomplish these tasks.

great information here. i’m ding my best this year. i was on track and then covid hit and i took a hit with work. i’m still doing my best though and will keep on trucking along.

2020 is already we spending less. No trips, no outings spring already on peek. Nice post!

This is definitely one of the things I want to do this year as well. This post provides a lot of good places to start getting on a good financial track. Thanks!

These are great tips. I follow Dave Ramsey and he would approve! Thanks!

It will be really difficult to gain financial freedom this year, hope that after coronavirus everything will come back to normal. I’ll keep your tips in mind. 🙂

Being lockdown is already helping me get my finances in order due to not having to drive as much and work related expenses, you post has given me added inspiration to become debt free

I am glad that I paid off my mortgage last year. It sure does help with our finances

I really do need to get my financial life in order. With everything that is going on we must try our best to be prepared for the future. thanks for the advice!

I actually just got my last credit card paid off!!! It truly is the year I get on my feet. I’ve always had good credit, but this will be so much more. I will be in control!

Ahh..a topic close to my heart. I love writing about personal finance too. We have the power to either be smart about our finances and become financially successful or be ignorant and not successful. It’s something that really isn’t taught it school and I love when people take control of their finances. I follow all of these steps and it has led our family to become debt free (having paid off more than $130,000 in consumer debt).

Nice saving tips and ideas! We all need to manage our finances wisely and save.

Thanks for sharing and actually there are some good insights for us as well! Great inspiration – Knycx Journeying

Thanks for sharing! I really like your suggestions, especially living on less. That’s one that I’m usually pretty good at and then will have an online shopping spree or something haha. It’s always good to have a reminder!

I don’t know if any of this can really be made use of by most of us in this pandemic… I mean, maybe some tips on reducing costs and finding creative ways to earn extra cash would be helpful. Many of us don’t have jobs anymore. I don’t have any cash flow right now, and am lucky to temporarily not have many bills.

Excellent tips for less hectic times, though!

This is an excellent post, we all need to keep an eye on our finances and budget. I think making an incoming out going spread sheet helps to show you how your finances are month to month.

There are some really good tips here for sure. I think to celebrate successes is so important as it keeps you motivated x

Thank you so much for these tips. I definitely need to follow this. This is the year!!

Thanks for sharing this! Those ways are all good to concern at this moment particularly

Great ideas! I do believe 2020 is a great way to gain more control over everything

I think that 2020 is going to be a very difficult financial year for many due to the pandemic we are living in. So many people have lost their jobs and are forced to live out of their savings. I can’t even think of those who don’t have any savings…

This is a difficult year for everyone, financially. One of my new year resolutions was to improve my finances. I will use your tips as much as I can. Thanks for sharing.

These are all great tips, especially the one about getting rid of debts ASAP. I think this is where a lot of people struggle.

These are great tips. Financial freedom is a beautiful thing for everyone to work towards.

Really, dnt doubt your update, but this pandemic has made it a tough year. Finances are down.

Thanks for sharing….. some tips are really encouraging, but in practice, its not just easy. But we gotta keep trying to keep our financed afloat.

Pingback: 7 Ways to Make 2020 the Year to Take Control of My Finances | Sometrical

Pingback: How much home can I really afford? Home Loan Prequalification Calculator

Pingback: Five Cities that Make Home Feel Like Paradise

Pingback: What is financial infidelity

Pingback: How to Live Well on a BudgetHow to Live on a Tight Budget