OnePricesTaxes.com – Tax Preparation Made Simple

It is tax time again! Are you anticipating a tax refund? Do you need to file taxes online? Want to e-file state taxes online? No need to keep your taxes waiting. You can fill...

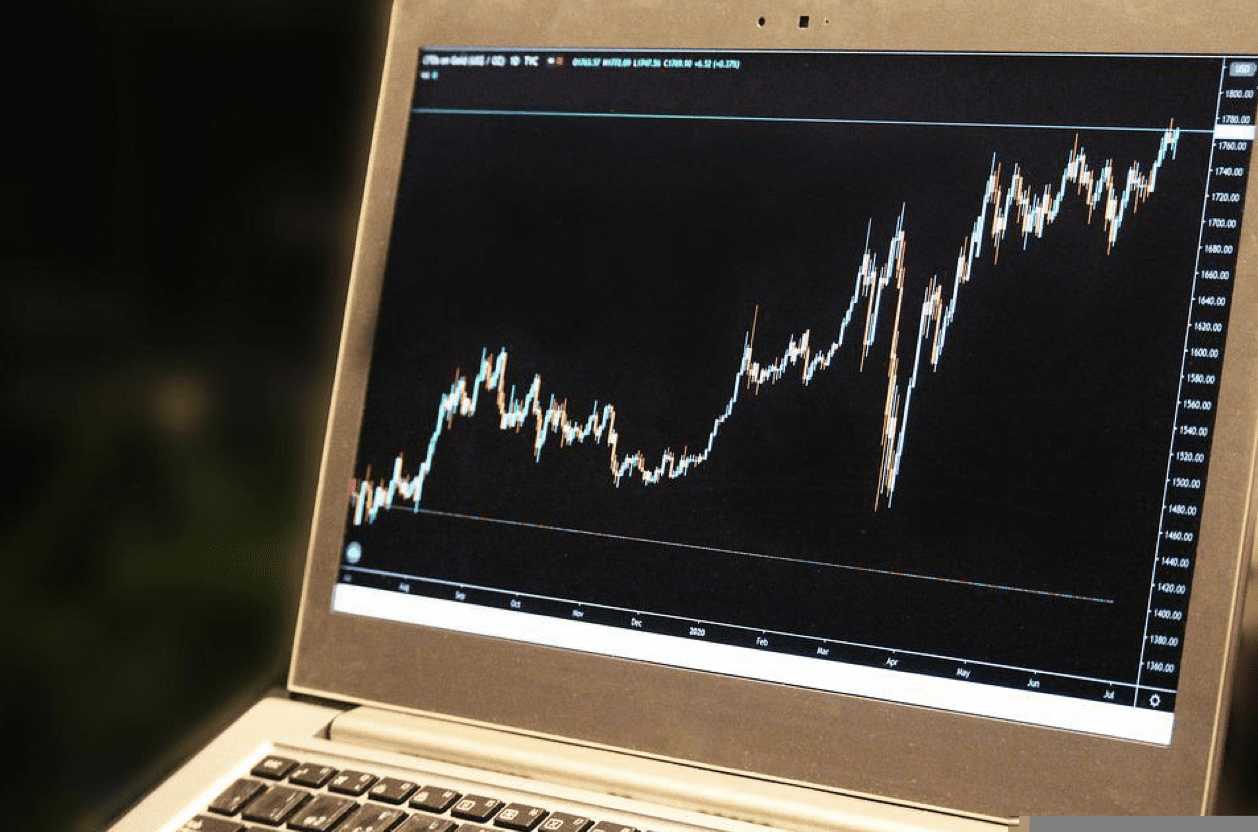

Trading gold does not necessarily mean buying bullion, such as coins. The digital world is changing how you invest in different commodities, including gold. So, now you can go online and start gold trading without going through a lot of trouble.

Gold trading is not new and dates back to the Roman Empire. While the primary purpose of gold is for jewelry, many people invest in it to ensure their money doesn't lose value over time.

So, this article will tell you the step-by-step process if you want to start with an online gold trading journey. You can also learn the factors impacting gold prices to help you buy this precious metal at the right time. Let's get right into it.

Gold trading is all about having the right tools and instruments by your side to help you leverage the potential opportunities. You must follow each step carefully to ensure you start your investment journey on the right track. As an investor, you must remember that gold trading comes with many risks.

Since it is a highly volatile market, you will see constant price fluctuations. Consequently, you might incur hefty losses when investing in the gold market. Nevertheless, you can follow the stages below to ensure you begin your gold trading journey on the right course.

Before you start with gold trading, you must have a clear set of goals. It will ensure that you develop the best strategy when buying, selling, or trading gold. The plans can vary from person to person, but these are the most common ones that many people have:

Like investing in the stock markets, you need to choose an online broker for gold trading and investing. There are plenty of online brokerage houses available, but you must go through the benefits they offer to choose the best one.

The broker should allow you to invest in the gold market in various ways, such as buying shares of the gold mining company, futures, gold ETFs, etc. Also, they should give you regular information about the gold markets. The updates and information will influence your gold trading and investing decisions.

Gold trading requires you to carry out due diligence and create a proper strategy before you put your money into it. Going without a plan means you will be subject to high volatility and incur losses on your investments. Therefore, you must create a plan before buying, selling, or trading gold.

If you can't come up with a gold trading technique, you can take inspiration from other individuals. You can look at their strategy to find out what is working for them and what is not. Once you have your strategy, you need to test its effectiveness.

Gold trading without testing your strategy means embarking on a journey with no routes, maps, or compasses. Therefore, you need to test your strategy with a small initial investment to check if it is working. Many online traders give you a demo account, which helps you check your method.

Once you successfully test your strategy, the next thing you need to do is start online gold trading on the platform. Most people tend to make emotional decisions due to the changing market sentiments. You must stick to your plan to enjoy an optimal ROI.

Gold trading comes with many advantages for short and long-term investors. If you come up with a proper plan and understand the trends affecting the gold market, you can profit. Here is a list of factors that impact the gold markets:

Gold trading presents various benefits such as helping you accumulate wealth and enjoy profits over time. With a proper understanding of the trends, you can easily take leverage of the gold market at the right time.

Also, finding the best online gold trading broker is vital to benefit from the opportunities in this market. It is best to go through the pricing structures and additional features that the different brokerage houses give before making the final choice.

Comments are closed.

Pingback: 5 Top Tips For Preventing Identity Theft - Divine Lifestyle