Financial Literacy for Teens

posted by Stacie on July 18, 2021

// Comments Off on Financial Literacy for Teens

Financial Literacy for Teens

In our capitalistic society, financial education for teenagers is essential. Few high schools and colleges require proper training, placing many parents and guardians in the teacher role. The teenage years are the optimal molding times for economic learning. By adolescence, individuals typically understand why parents go to work and the functions of money. They will likely carry your financial values with them into adulthood. A combination of sit-down conservations and real-life modeling can prepare your teen for financial security. We hope this Financial Literacy for Teens post inspires you.

Image from Depositphotos

Wants Versus Needs

Though it may seem obvious on paper, influential online marketing may blur the line between a want and need. Teens spend a significant amount of time on social media, influencing their purchasing decisions. Brand representatives and influencers use strategic marketing methods, to develop a connection between a product and a follower. The influencer may show up as a friend, gaining a follower's trust. When they display a new product, they may display its improvement in their happiness, health, and more. They may convince their followers that they need a product when, in reality, they are safe and happy without it.

Parents may teach their teens the difference between a want and a need by asking them to wait a week before buying the goods or services. If waiting a week interferes with their health, safety, or well-being, the purchase is necessary. Any other effects may signify a want. Teens may learn to fulfill all their needs financially before evaluating their wants. Over time, the line between the two purchase categories becomes strongly defined, helping individuals save money.

https://divinelifestyle.com/how-to-become-financially-literate/

Purchases Have Trade-Offs

Parents may additionally teach their teens that certain purchases have trade-offs. Indulging in costly purchases may be essential occasionally, and they affect other investments. You can display purchase trade-offs by establishing a visible representation of your teen's income and savings.If your child has paper money savings, you may enter their profits and purchases into a spreadsheet. You can additionally utilize online financial apps and tools through your bank, displaying economic trade-offs. Before your teen buys a costly item, you can enter it into the calculation tool, examining the other purchases it affects.

A typical and applicable example parents may use in this lesson derives from restaurant eating. Groceries are significantly less expensive than eating out. On average, restaurant owners mark up a meal by 300%, attaining high profits. You may show your teen how many meals they can produce with the amount of money spent on one restaurant dining experience. They can gather the importance of purchase trade-offs by tracking the financial differences and impacts on necessary spending.

You may also display the importance of social gatherings and connections on mental health. Though eating out is costly, it is an excellent way to connect with friends occasionally. It is helpful to calculate experiences and social value when determining trade-offs.

Increasing Financial Literacy

Planning Future Purchases

A significant element of financial literacy derives from saving. Teens can save money over time by planning out their purchases. Learning to spend efficiently rather than on impulse can significantly increase one's earnings. You can promote efficient spending by teaching teens about delayed gratification. Rather than purchasing a new video game on the release date, individuals can challenge their urges and wait until the next version comes out. Waiting an additional six months or years can increase one's savings and satisfaction when they finally make their purchase.

Parents can set and track money goals with their teens, strategizing ways to prevent spontaneous spending. Rather than taking their paycheck to the mall and purchasing whatever clothes they like, teens may research an article of clothing they need and buy a single piece. Over time, they can build a new wardrobe while increasing their savings, and improving their financial security and style.

Best Gifts for High Schoolers

Credit

Many teens are excited to access their credit cards. Though the financial tool helps individuals meet their economic needs, it is also essential for a life of investments. Teach your teens about the connection between credit and making major life purchases. You can discuss the differences between a credit and debit card, and the pros and cons of each. Teens can even have their debit card, for real-life experience with managing money.

You may explain how a credit card works in terms of an exam at school. It is a tool that allows you to prove your financial responsibility to the bank. Depending on what you purchase and how quickly you pay it off, the bank provides you with a score, like a grade. If you receive a high score, you can make more significant purchases. Low-scoring individuals must wait longer and prove their responsibility before accessing additional perks. Parents may also describe the longevity of credit mistakes.

When you apply for a job, take out a loan, purchase a car, or buy a home, you must present your credit score. Low-scoring individuals will have limited access to independent purchases. It also takes time to regain the bank's trust, affecting years of spending.

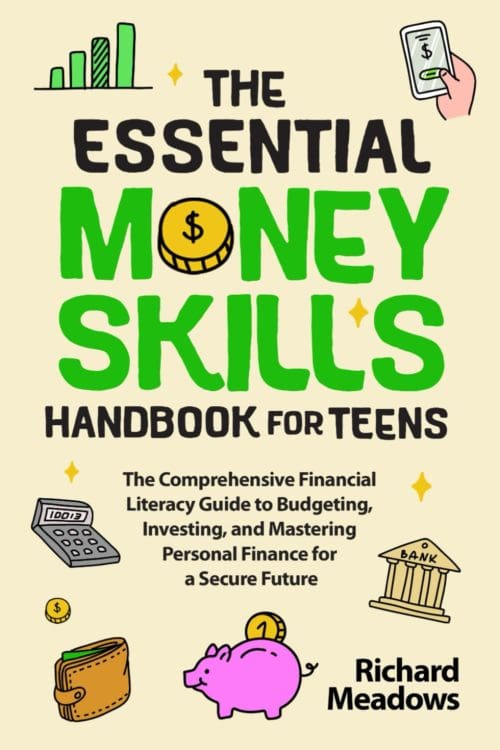

The Essential Money Skills Handbook for Teens

Lead By Example

The best way to teach your teen about economics is by practicing what you preach. When you make purchases in front of them, explain your reasoning behind spending and label it as a want or need. You can also create a purchasing planner for yourself and involve your child in the process. Over time, your teen will adopt the excellent spending habits you pass down. By the time they leave for college, they will have adequate financial literacy skills. We hope this Financial Literacy for Teens post inspires you. Good luck!

Comments Off on Financial Literacy for Teens