TurboTax Federal Free Edition

TurboTax Federal Free Edition

The TurboTax Federal Free Edition is a free tax filing option offered by TurboTax for simple tax returns. It allows you to file both your federal and state tax returns without any cost, as long as your tax situation meets certain eligibility criteria. We hope that this TurboTax Federal Free Edition post inspires you.

TurboTax Federal Free Edition

For tax season simplicity, TurboTax Federal Free Edition offers a no-cost way to file both federal and state returns, perfect if your finances are straightforward. Think W-2 income, basic credits like Earned Income, and claiming standard deductions – if that's your tax picture, this edition has you covered. Free guidance walks you through the process, and e-filing secures a speedy refund. But remember, its free nature means limited features. More complex situations likely require an upgrade and claiming every potential deduction might not be an option. Still, for clear-cut tax situations, TurboTax Federal Free Edition delivers ease and value without breaking the bank.

What it includes

- Free federal and state tax filing: This includes Form 1040 and all standard IRS forms.

- Basic guidance and support: You'll get help with entering your income and deductions, but advanced features like live expert assistance or importing W-2s are not available.

- E-file and direct deposit: You can file your return electronically and receive your refund directly into your bank account.

Find Every Deduction and Set Your Business up for Success with TurboTax Self-Employed

Eligibility

- Form 1040 only: You cannot use this version if you need to file additional forms like Schedules C, D, or E.

- Limited credits and deductions: You can only claim basic tax credits like the Earned Income Tax Credit and Child Tax Credit. More complex deductions may not be available.

- W-2 income only: This version is mainly for people with income from W-2s and no other income sources.

Free filing for simple returns

- Ideal for filers with W-2 income, limited interest and dividend income, the standard deduction, and common credits like the Earned Income Tax Credit and Child Tax Credit.

- You can use Form 1040 and claim a limited number of tax credits.

- Not suitable for complex tax situations involving itemized deductions, rental income, investments, or self-employment.

https://divinelifestyle.com/taxes-made-easy-with-turbotax-self-employed-and-quickbooks-self-employed/

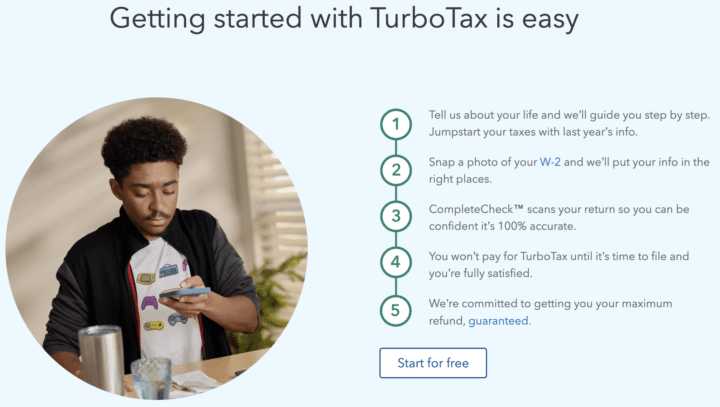

User-friendly interface

- Guides you through the filing process step-by-step with clear instructions and helpful tips.

- Imports W-2 forms automatically for easier data entry.

- Provides on-screen explanations and context to navigate tax terms and concepts.

Accuracy and guarantees

- TurboTax guarantees accurate calculations and freedom from IRS penalties and interest caused by software errors.

- Offers free audit support and review if you are selected for an audit.

Limitations

- Doesn't include support for state filing fees (varies by state).

- Limited access to expert help within the free version.

- May prompt you to upgrade to a paid version for more complex forms or additional features.

https://divinelifestyle.com/4-things-need-know-turbotax-taxes-healthcare-turbotaxaca/

Resources

Pros

- Completely free for eligible filers.

- Easy to use for simple tax returns.

- E-file and direct deposit for faster refunds.

TurboTax Self Employed

Cons

- Limited features and support for complex tax situations.

- You might need to upgrade to a paid version if your tax situation changes.

- May not be able to claim all available deductions and credits.

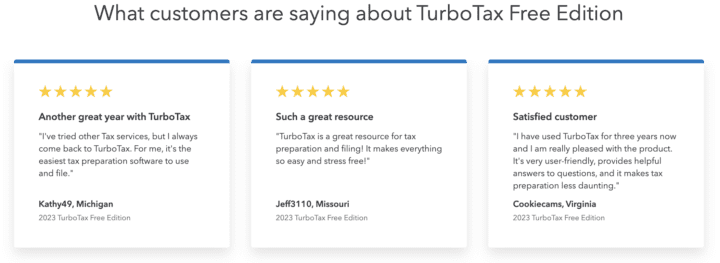

Overall, TurboTax Federal Free Edition is a great option for taxpayers with straightforward tax situations who want to file their returns electronically and maximize their refund without any extra cost. However, if your tax situation is more complex, you may need to consider paid versions of TurboTax or other tax software options. We hope that this TurboTax Federal Free Edition post inspires you. Good luck!

You May Also Like

Turbo Tax is not a bad options. Many people who have their taxes done by accountants could easily use Turbo Tax. (I know because I have worked as an accountant and done extremely simple returns.) If your taxes are straightforward and you do not have rental real estate or trade stocks (or something odd). Turbo tax would meet your needs.

Pingback: Turbotax Health Insurance

Pingback: Taxes Made Easy with TurboTax and QuickBooks