What is the Going Rate for the Tooth Fairy?

What is the Going Rate for the Tooth Fairy? Your child’s first tooth loss marks a critical milestone for them. It serves to remind you both that they’re growing up quickly, one that typically...

The gig economy is one of the fastest growing segments as more and more people are turning their side hustle into a business. I should know because I did exactly that. Years ago when the economy was struggling, the company I worked for just cut my position in the company. At the time, I had my side hustle and I was devoting some time to it. I was doing pretty well. However that layoff? It jumpstarted what has been the absolute best decision of my life. I hope that you enjoy this Find Every Deduction and Set Your Business Up for Success with TurboTax Self-Employed post.

This freelance thing is not without its challenges. Tracking my finances is a huge deal because I need all of that financial information for the next year. Up until last year, I wasn't so great about keeping track of my expenses but with TurboTax Self-Employed, they make it easy to know what is deductible. For instance, that rideshare that I took to a business event? It's deductible. I had no idea. Those tolls on the way to the airport and the parking at the airport for a press trip? Yeah…deductible. There are millions of self-employed individuals and TurboTax Self-Employed gives you the tools that you need to automatically find industry-specific business deductions and expenses PLUS you get on-demand access to real CPAs with TurboTax Live Self-Employed.

This exclusive TurboTax Self-Employed feature looks for unique deductions across multiple industries (consulting, online sales, real estate, and more) to help you find those industry-specific business deductions that you might not have known about.

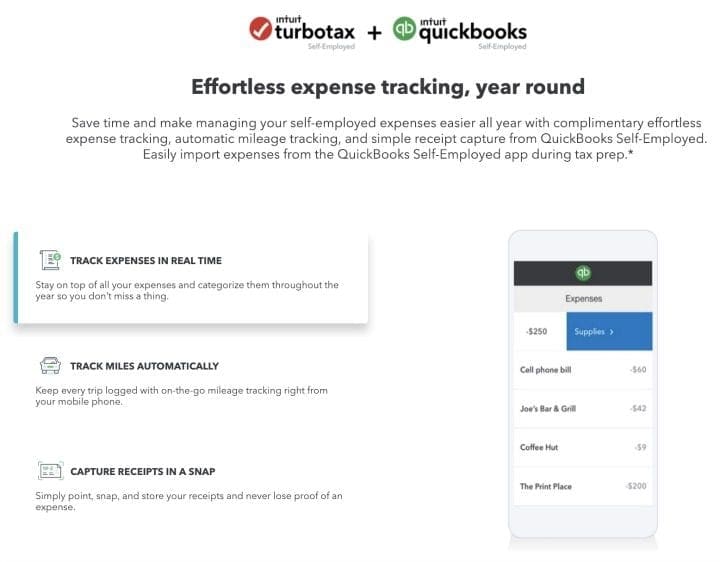

Effortless expense tracking, year-round

Effortless expense tracking, year-roundTurboTax Self-Employed comes with a complimentary one-year subscription to QuickBooks Self-Employed. This has saved me. We started using QuickBooks a few years ago and it revolutionized the way I did business. With QuickBooks Self-Employed you get:

QuickBooks Self-Employed and TurboTax Self-Employed work together to maximize your self-employed deductions at tax time, track expenses all year and automatically imports data into your tax return so you can keep more of the money you earn which gives you an easy filing experience.

Expense Finder with QuickBooks Self-Employed

Expense Finder with QuickBooks Self-EmployedExpenseFinder from QuickBooks Self-Employed securely gathers business expenses by automatically checking credit card transactions and scanning your bank accounts for potential deductions. You can confirm which expenses are for your business.

Personalized Audit Assessment

Personalized Audit Assessment This NEW TurboTax Self-Employed Audit Assessment completes an in-depth analysis of your self-employed income and expenses and then compares it to IRS guidelines checking for red flags. This gives me peace of mind and confidence that I am doing things right.

DIY or Get Expert Help

DIY or Get Expert HelpYou can Do It Yourself or you can click to connect with a real tax expert to get answers to your self-employment questions with personalized guidance right on your screen. NEW this year TurboTax Live Self-Employed connects self-employed taxpayers to live, credentialed, CPAs, Enrolled Agents (EAs), and Tax Attorneys, with an average of 15 years of experience to ask questions, get unlimited tax advice or have their return reviewed, signed, and filed for them. All advice or reviews from CPAs and EAs are guaranteed, for 100% confidence. Now you can get unlimited help and advice all year long.

TurboTax has combined on-demand tax expert help with technology to give you the best, most personalized experience possible. So freelancers, independent contractors, and gig workers, let TurboTax and QuickBooks help you with tracking expenses and filing taxes, so you can concentrate on the things that you are good at like that side hustle. With their tools and your business savvy, TurboTax Self-Employed is just the partner you need to file your taxes with confidence and get every dollar deserve. Get started today with TurboTax Self-Employed and you'll be on your way to finding every deduction you qualify for.

This Find Every Deduction and Set Your Business up for Success with TurboTax Self-Employed post is sponsored by TurboTax.

https://divinelifestyle.com/taxes-made-easy-with-turbotax-self-employed-and-quickbooks-self-employed/

I’ve used Turbo Tax in the past and it really is so simple and accurate! I can’t wait to use it again this year and see what our finances will look like under the new tax plan.

I didn’t realize that quickbooks and turbotax went hand and hand together! That is going to make doing my taxes a breeze!

i use quickbooks and turbotax both to help managing my business and love them/it. it’s such a great way to track income/expenses/taxes.

Thanks so much for this info!

Bookmarking this for next week when I start working on my taxes! Thanks for the tips.

Absolutely excited for the event and to learn more

This sounds *so* helpful! I have a hard time keeping up with blog expenses and forget about things that can potentially be exemptions. This program can help so many self-employed business owners.

I use Quickbooks but haven’t come across Turbo Tax before. I’m definitely going to be checking them out now though 🙂

Louise x

I’m going to make a point of attending the Twitter party. I’ve got some questions about Turbo Tax that if it can do what I want, will make me a Quickbooks convert!

I have used Turbo Tax home and business for 10 years now. They make it really easy!

I discovered that using Turbotax saves me a lot of headache when filing our taxes. Having Quickbooks really makes it that much easier!

These sound awesome for keeping everything organized year-round. The ability to record receipts and expenses is going to be so helpful.

Self employment taxes can be a bit challenging. Turbo Tax self employed seems like it would be SO helpful.

I have heard of Turbo Tax. In fact a friend of my mine recommended it to me. I’m yet to try it out. Thanks for the review.

TurboTax Self Employed looks like a great tool for everyone that has their own business! Will check it out!

Our accountant retired this year and I find the required self employment tax forms to be so overwhelming. I think we could really benefit from this version of TurboTax. Thanks for sharing!

I’m learning how to get better with my business! The tutorials sound like they may actually help a lot!

I have been using TurboTax for years but the Home & Business version since I do my husband’s taxes as well. I need to start using Quickbooks as well.

I am not self-employed but this is great advice for those that are. We used to use an accountant but now my husband does our taxes.

I have used turbo tax for years. It really does make doing your taxes easy.

Ooooo turbo tax sounds like an awesome option for all the boss babes out there!!! I will have to look into it!

This is what i really needed. We know how gard to track expenses and this seems to be a very useful tools to help us.

This sounds like a great tool that we can use to trach our expenses. Something that can be very helpful. I’ll have to check this out now.

These tips are so helpful. I will definitely follow them!Thank for sharing them!

those are really a great tips – i am so bad when it coes to tracking my expenses

Doing your own taxes is probably one of the best things that you can do. Thanks for your recommendation.

Tax season! I’ve never tried this before but would love to check it out. It might be better than what I use now.

sound useful! I wish I could use this app to help me with my taxes. I always struggle to get it done properly.

I used to be pretty good about tracking my expenses to write off, but with the new tax laws, I feel like what’s the point.

Sorry to have missed the twitter party. I go to an accountant, but with less income, I may have to rethink that and use this tax info and do it myself like the old days!

Turbo Tax self employed is a great idea & will be so useful in tracking my expenses and finances.Thanks for sharing.I will start using this.

Thank you for sharing this. Going to check out Turbotax for our business success too. Thanks again

So many factors to take in consideration when doing this. I always get an accountant :p

We’ve saved a lot of money and time doing our taxes with TurboTax. Quickbooks is a god-send as well! Makes life so much easier.

This is great for everyone who is self-employed. I know a lot of my self-employed buddies and how tax season can be mind boggling. But if Turbotax can help, then that’s great!

I haven’t heard about TurboTax Self-Employed. Seems like a good tool for self employed individuals.

I used to love Turbo Tax Self Employed too. But, then things got a little more complicated with my returns and I opted for a CPA.

I’ve used Turbotax for 10 years! I trust and love it! Such a great resource for business owners!

I’ve used TurboTax in the past and love the program! With the new tax laws rolling out this year, I predict they have made things even easier for people to file their taxes!

I am planning on doing my own this year I really love this! Thanks for the info.

Interesting post – some great tips and advice here for the self employed! x

Interesting! Am already using this for my personal tax and just starting to use it for this year tax!

Turbotax is definitely the way that I go! It definitely has so much benefit to setting yourself up to succeed running your own business.

Interesting! it looks very useful for personal tax working .!

Pingback: TurboTax Federal Free Edition

Pingback: Taxes Made Easy with TurboTax and QuickBooks

Pingback: Turbotax Health Insurance