Five Below where everything is $1 to $5, or $5 & below

I recently went shopping with my three kids to check out our local Five Below store. I had passed it countless times but had never been inside. Our mission was simple, each kid got...

For years, I worked for others. I spent a long time in the corporate world at various jobs that all revolved around marketing. Those years centered around the typical 9-5 job although that is a myth because I have never had an employer who thought working only 40 hours weekly was ok. Most of my salaried positions were around 55-60 hours per week and that seems to have been standard in my industry. We hope that this Taxes Made Easy with TurboTax and QuickBooks post inspires you.

One of the best things that I have ever done was to start my own business. After having three children, I realized that I no longer fit into the corporate world and that I needed to stretch my creative wings.

I started my blog and social media company in 2009. In 2013, my husband could leave his full-time job and work with me. Our children work with us as well and while we have a unique family dynamic, our entire family has never been happier.

One of my favorite quotes about being an entrepreneur is from someone who I admire. Lori Greiner is called the Queen of QVC on Shark Tank each week as she makes decisions on whether or not to invest in a business. She said, “Entrepreneurs are willing to work 80 hours a week to avoid working 40 hours a week.”

This quote sits on my desk because every single day, I think to myself, “I am so lucky to get to do something that I love. I work for myself!” This is me. I sometimes work 100 hours a week (especially during the 4th quarter) and honestly, it never feels like it.

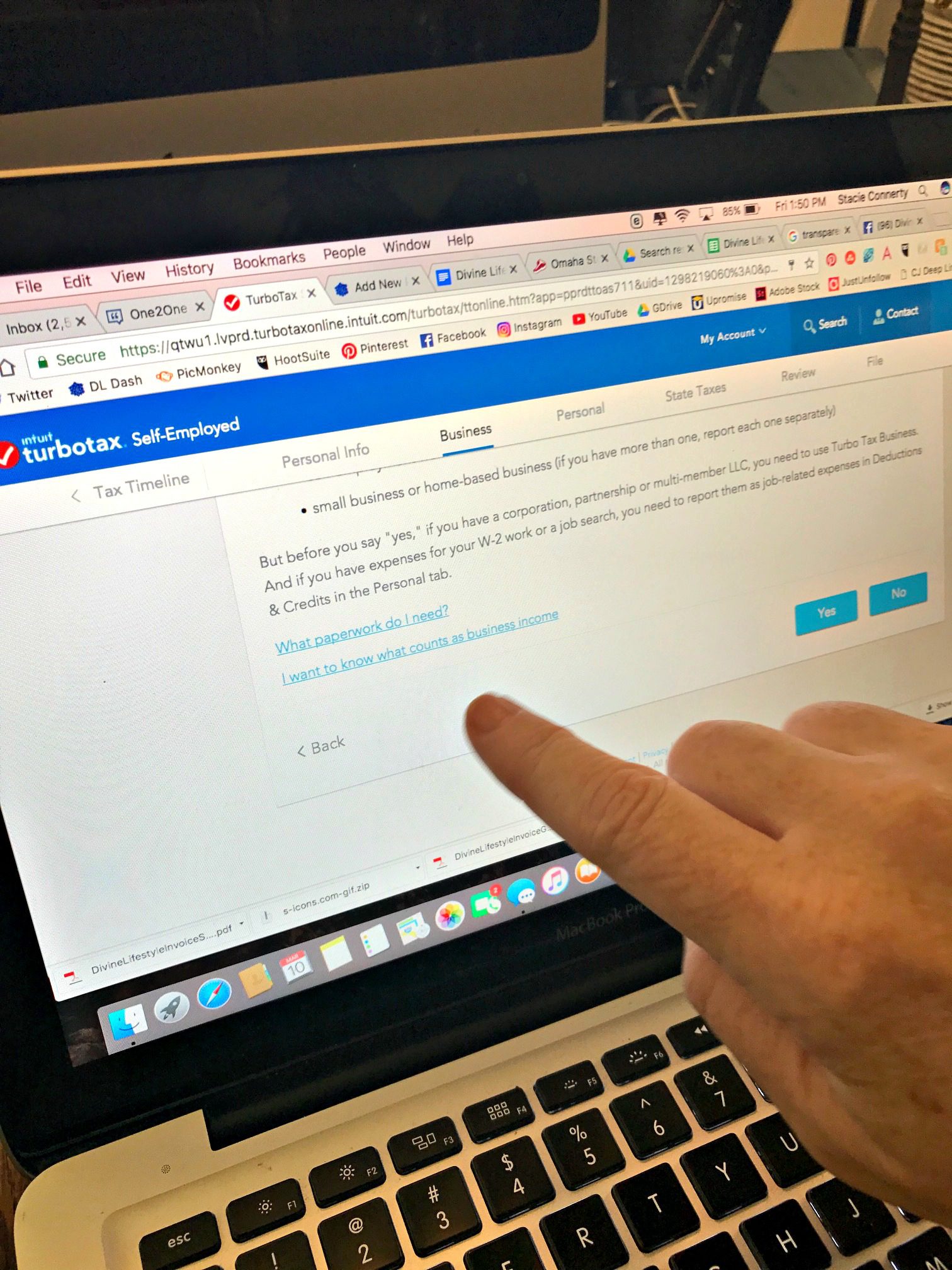

This year, we are filing our taxes with TurboTax Self-Employed.

Although working for myself is one of the best decisions I have ever made, being self-employed is no easy feat. TurboTax Self-Employed helps me manage and find every business deduction plus offers credentialed industry experts on-demand to answer my tax questions at no charge.

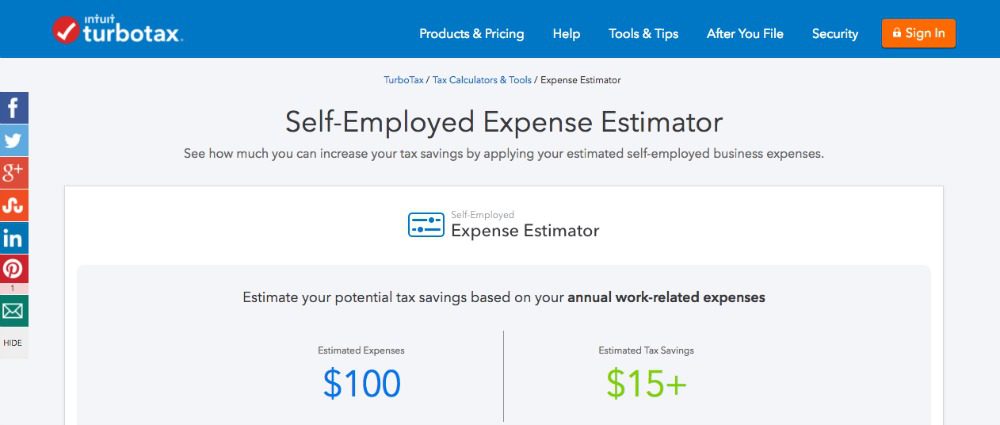

With over 55 million self-employed taxpayers, TurboTax “delivers the first and only year-round integrated tax preparation and expense tracking solution.” Here are a few tools that I used with TurboTax Self-Employed that enhanced my experience:

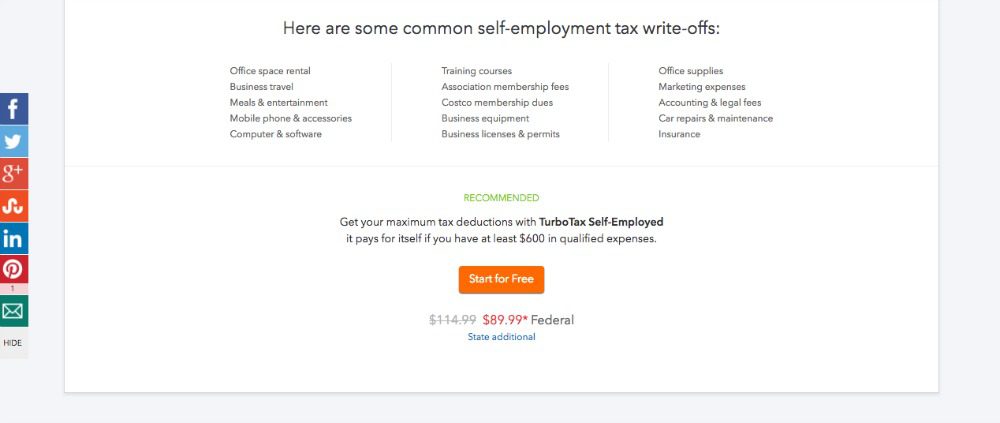

Expense Finder, exclusive to TurboTax Self-Employed, helps you find deductible business expenses that many of the self-employed might not know they can claim which saves you money.

The beauty of Expense Finder is that you can start to add your expenses and then come back at any time to finish them. This is great for me because often I need to locate some paperwork or a file.

Expense Finder works by securely accessing and scanning your credit card transactions and bank accounts. Next Expense Finder will recommend potential deductible business expenses and allow you to confirm which expenses apply to your business.

Expense Finder found several deductions for me that I hadn't even considered plus it automatically imported, organized, and categorized all of my expenses.

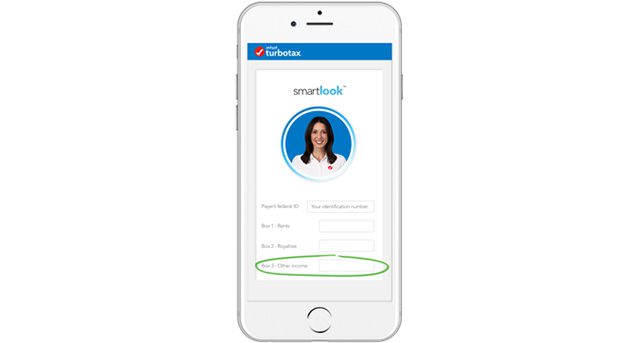

Need personalized help? TurboTax SmartLook provides you an exclusive way and priority access to “connect live, via one-way video, to credentialed CPAs or Enrolled Agents to get personalized, real-time answers to their tax questions whenever they need it – at no additional cost.”

Connect in real-time with a TurboTax representative after scheduling an appointment at a time convenient for you. The best part about SmartLook is that there is a screen-sharing capability that allows your tax expert to guide you while circling and highlighting info on your screen. In addition, there is a one-way video allowing you to see your tax expert but they can't see you providing an extra layer of privacy.

TurboTax Self-Employed customers get a free subscription to QuickBooks Self-Employed through the next tax year. This lets you:

Essentially QuickBooks Self-Employed helps you by preparing your taxes throughout the year rather than during those last few weeks before the due date. You can stay on top of your expenses and deductions while categorizing them.

Your data is automatically imported from QuickBooks Self-Employed into next year’s TurboTax for a simple experience.

With TurboTax Self-Employed, I can file my taxes with confidence knowing that my questions have been answered and that I have maximized my deductions.

TurboTax Self-Employed tools like Expense Finder let me confirm my business expenses with a click which means I keep more of the money that I earn. We hope that this Taxes Made Easy with TurboTax and QuickBooks post inspires you. Good luck!

This Taxes Made Easy with TurboTax and QuickBooks post is sponsored by TurboTax.

Find Every Deduction and Set Your Business up for Success with TurboTax Self-Employed

My hubby is an accountant and he uses TurboTax. He always says how easy it is to use 🙂

This really is an awesome way to streamline doing your taxes. Their expense finder is so cool! Making it easier to track deductible expenses would be great.

I use TurboTax when doing my taxes. It’s pretty easy despite me being self-employed!

It really is that time of the year isn’t it? Looks like I’ll be checking out TurboTax soon myself!

These look like great options. I could see how this could be a big help.

My husband uses TurboTax for our taxes every year. Since I am self employed and he is full time working outside of the home, taxes can get confusing. But TurboTax helps take the guesswork out of doing them ourselves.

We remembered to take advantage of Turbo Tax this year. Avoiding the headaches and stress is our priority this Tax season!

It’s my first time to heard about this Turbo Tax, sounds fascinating! I’ll check it out./

I love that there are so many great resources available now to help self-employed folks manages their taxes and accounting. Makes things so much easier!

That looks so easy to use! I wish I saw this before I did my taxes! Will try this next time.

THIS! SO MUCH THIS! I HATE doing my taxes, but what I hate even worse is paying out the nose for someone else to do them. With this, I might be able to get it done right!

THIS! SO MUCH THIS! I HATE doing my taxes, but what I hate even worse is paying out the nose for someone else to do them. With this, I might be able to get it done right!

2ish years ago I tried doing this myself and it was a big fail. Like, big fail! I want to try again this year hopefully now with this knowledge i can succeed

I had no idea they made a self-employed version! I’m glad I know this for next year!

I have lots of friends that use TurboTax and they always have wonderful feedback for it. They’re trusty and reliable!

I love hearing the words ‘taxes’ and ‘easy’ in the same sentence. I will definitely have to check this out before I do mine!

I have never used Turbo Tax, but would probably be the one I would use if I didn’t have a CPA who does all my tax stuff. It is one of those companies that you hear their names all the time, so they have a great reputation

I love being self-employed. But, you are right, come tax time, it can get really stressful. I think TurboTax could really help me out. I need to try it.

Honestly, I’ll work 120 hours per week to ensure that I’m building my own dreams. Thanks for sharing. – yolonda

I have yet to do mine though I know it is getting late in the month,. But I have got to get a start on it soon.

This sounds like a great way to get your taxes done. I have been thinking of trying to do my own this year. Turbo Tax looks like it makes it easy.

I have used TurboTax for that last couple of years now and really loved them!! Great post!!

I still haven’t done our taxes yet. I always dread doing them but I shouldn’t. Next year, we will definitely need help because my husband launched a business.

I haven’t used Turbo Tax, but it sounds like a great service. I know many that do use it and love it though!

This is a great post! We use TurboTax for our taxes each year.

We’ve used Turbo Tax for years. It’s super easy to use and a wonderful way to streamline doing taxes. It handles everything from our small business to my husband’s salaried position. We especially love the expense finder .. I swear me miss things if left to our own devices!

Man April is quickly approaching. Cant believe it. Turbo tax seems like a really great way to get our taxes done this year. I always look for apps that make tracking deductibles easy. I’m so trying this. Thanks

It was only recently That I discovered Turbo Tax. I love how easy it is to use.

We use Turbo Tax and highly recommend it as well. We have used it for about 4 years now.

If I ever do my own taxes, then this sounds like something perfect for me. I definitely need something that will make the process easy. I really like the Expense Finder feature.

TurboTax is fantastic and so easy to use! We file with it every year!

I am self-employeed and this is awesome! Their expense finder is so cool! Making it easier to track deductible expenses would be great.

Pingback: TurboTax Self-Employed Small Business Owners Taxes

Pingback: RSVP for the #TurboTaxSelfEmployed Twitter Party 3.23.2020 8-9pm EST | Divine Lifestyle

Pingback: RSVP for the #TurboTaxTogether Twitter Party 4.02.2020 1-2pm EST

Pingback: 7 Ways to Make 2020 the Year to Take Control of My Finances

Pingback: TurboTax Self-Employed

Pingback: TurboTax Federal Free Edition